How to Prevent Sticker Shock, Help Your Customers Afford What They Need, and Look Good Doing It

You’ve got what they need. They know it, you know it.

All that is standing in the way of a successful sale is one number – that piece of equipment’s price tag. Equipment is a big-ticket item and the numbers involved can send a potential buyer running for the door.

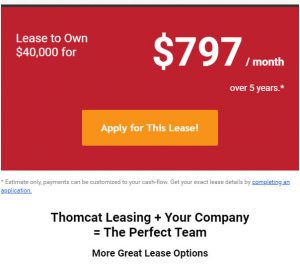

The key to increasing sales lies in reframing the price tag with monthly payment plans. Breaking down that sticker price into manageable chunks helps your buyer reframe the equipment cost in a way that fits their budget – and thought-process. Few small operators can lay down the $40,000 needed to purchase a mini excavator upfront. But, $800 a month for 5 years? That is a possibility. That number that fits the world of monthly operating costs.

Monthly Cost Breakdowns = Stronger Sales

Take our excavator example. Your customer knows it is going to take a while to see a profit if they have to cover that $40,000 off the top. But in an $800 a month scenario, that excavator is likely paying for itself right away. Suddenly that big purchase is sounding like a wise investment.

Confidence = Stronger Sales

There’s a big difference between telling a potential buyer that their monthly payment “should be around $800” and being able to say with confidence that it will be $800. The first phrasing triggers uncertainty and the desire to play it safe. Looking for financing requires commitment from a buyer. No one wants to commit without knowing the details. Removing the uncertainty and allowing your buyer to think in concrete terms enables them to see how the equipment will fit their cash flow, increase their income and ultimately benefit their business. Concrete numbers breed confidence.

Vendor Financing = Stronger Sales

The hard truth is that relying on the customer to arrange their own financing means fewer sales. Once they leave your lot, the likelihood of them buying from another vendor, or forgoing the purchase altogether, jump significantly higher.

Vendor financing is proven to boost customer buying power – allowing for greater flexibility in purchase decisions. And it eliminates the risk of another bank financing horror story. Ideally, you need to be in a position to tell your buyer exactly what their monthly payment will be on the spot. Far from running out the door, your buyer now sees your business as a one-stop-equipment-shop.

Your business looks great, your customer is happy – win, win.

But you’re not a lender, you’re an equipment dealer. The last thing you need is more paperwork, potential payment delays and a steep learning curve. And frankly, most lenders can be a pain in the neck to work with.

We Have Good News

The Vendor Toolkit from Thomcat Leasing puts the power of vendor financing in your hands. Simply and easily. 30 years of industry experience went into the creation of this toolkit and it shows. One link is all your business needs to offer on-the-spot financing to your customers.

No vendor fees.

It’s totally free to set up and totally free to use.

No hard-to-follow language.

Simple to understand and use, this kit was designed by people like you.

Fast lease approvals.

Get concrete numbers for your buyers in as little as 10 minutes.

Minimal paperwork.

Applications are done via secure online forms, and require just a little more info than you’d find on a typical business card.

Friendly, Canadian customer service.

Don’t want to deal with pushy sales calls and clueless salespeople? We totally understand.

Some of the best rates in the industry to pass along to your customers.

Think of this toolkit as an in-house financing department– without the payroll and the HR.

Quick, no-hassle, full payment on every sale, every time.

Use the Toolkit to submit sales invoices and we’ll make sure you are paid in full right away.

Thomcat Leasing’s Vendor Toolkit takes care of the paperwork, the legal stuff and finding a great rate for your customers. You are free to focus on what you do best—running your business. With this tool in your pocket you have the power to offer vendor financing and increase your sales. Check it out and set up your Vendor Toolkit link today.